UNION KNOWS!

THE REAL COST OF A UNION

You might think the cost of a union is what you would pay in dues, fees, fines, assessments, etc.

But there are two more ways to think about the cost of a union:

- What you don't make (because the union has your money)

- What you don't have (because you paid the union instead)

1. What you don't make (because you can't invest money you give the union)

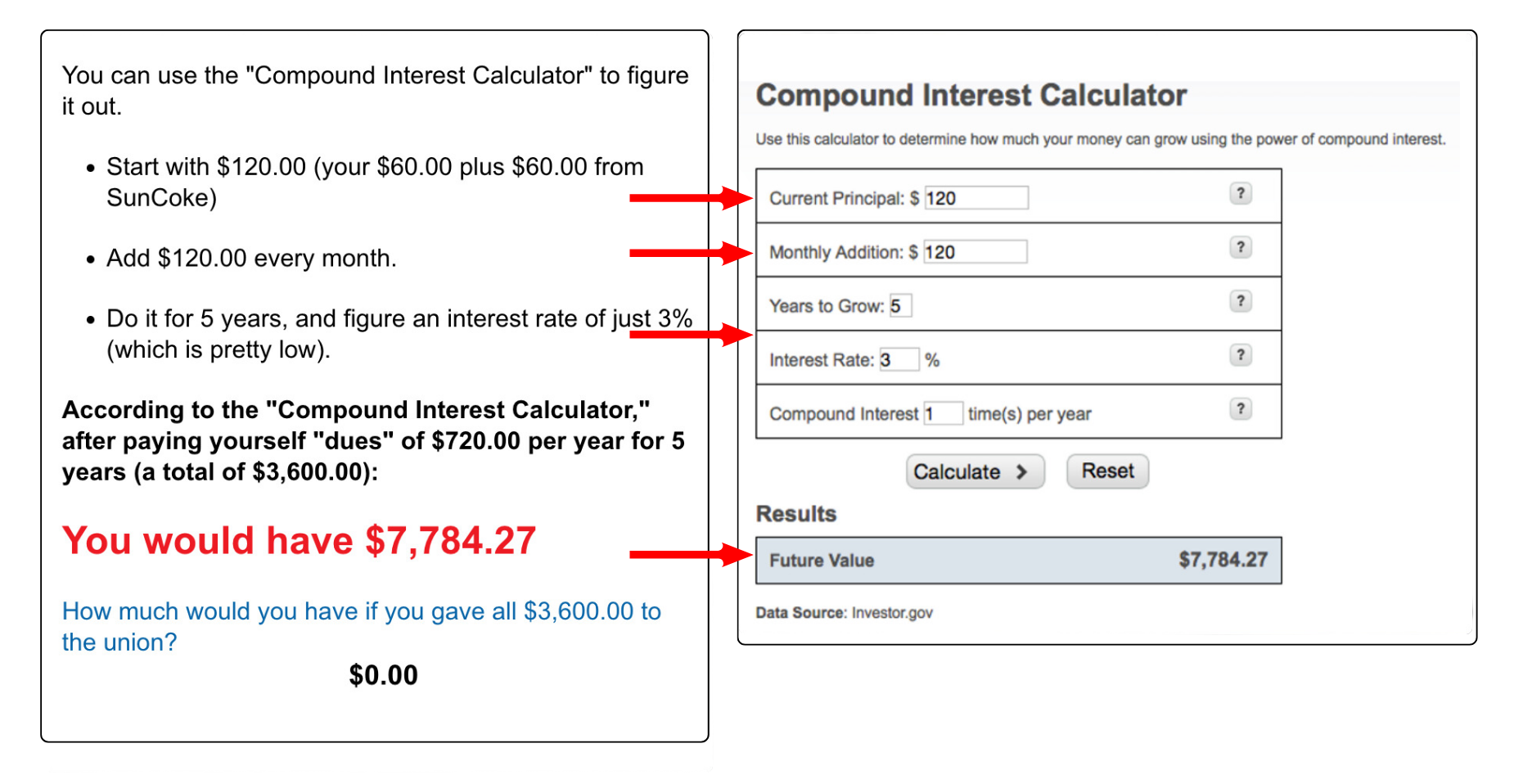

Suppose dues are $60.00 per month, or $720.00 per year.

What would you make if you took that money and put it into a 401(k) where it's matched by you?

To use the "Compound Interest Calculator" and try out various amounts of investment and return, click here:

1. What you don't have (because you can't buy things with money you give the union)

Suppose dues are $60.00 per month, or $720.00 per year.

What could you buy with that money?

- The U.S. Bureau of Labor Statistics found that families on average go to the grocery store twice a week - and spend an average of $60.00 each time. That's the same amount as your dues.

- If the price of gas is $2.50 per gallon, you could fill a 12-gallon gas tank twice each month with the money you'd pay in dues.

THE BOTTOM LINE:

Without a union, YOU decide how YOU want to spend $60.00 each month, and $720.00 a year can pay for a lot of your basic life needs.

Or, if you invest that money, it can make you a lot more money.

Or, you can just give it to a union.